Construction Financial Management in 2024: The Ultimate Guide

-

Sapna

- May 3, 2024

In 2024, construction projects will continue to face financial challenges such as fluctuating material costs, labour shortages, and complex regulatory requirements, which can derail budgets and timelines. Effective financial management is essential to navigate these issues and ensure projects remain profitable and compliant.

In this blog we have provided a an ultimate guide that provides comprehensive overview of modern financial management strategies in construction. It offers solutions to common financial problems, introduces advanced tools and software for budgeting and cost control, and explains how to optimise cash flow and comply with new tax regulations. So, explore the blog and learn all the techniques required to manage your construction finances more effectively.

Table of Contents

What is meant by construction financial management?

Construction financial management refers to strategically planning, monitoring, and controlling a construction project’s financial resources. It involves managing costs, revenue, and expenditures to ensure the completion of a construction project within its allocated budget and provides financial profitability and stability to the involved parties.

Key tasks in construction financial management include budgeting, cost tracking, financial reporting, and cash flow management. These tasks ensure that funds are used efficiently, risks are managed, and financial goals are met throughout the project’s life.

Why is Construction Financial Management Important in 2024?

Construction financial management is crucial because it directly influences the financial health and success of construction projects. Effective financial management ensures that projects are completed within budget and on time, enhances profitability, and minimises financial risks. It involves precise budgeting, diligent monitoring of expenditures, and thorough cost control, which is essential for making informed decisions affecting the project’s outcome.

Additionally, it helps maintain cash flow, which is vital for continuous operations and the ability to fund future projects. Proper financial management in construction also ensures compliance with legal and regulatory requirements, helping to avoid costly legal issues and penalties.

Benefits of Effective Construction Financial Management?

Effective construction financial management offers several benefits to construction companies and stakeholders. Some of the key benefits include:

- Improved Cash Flow: Proper financial management ensures that cash flow is managed effectively, preventing cash shortages and ensuring smooth operations. It allows construction companies to pay their suppliers and contractors on time, enhancing relationships and reputation.

- Accurate Financial Forecasting: Financial management provides accurate financial data and analysis, allowing companies to forecast project costs, revenue, and profits. It enables better decision-making, resource planning, and evaluation of project viability.

- Enhanced Profitability: Construction financial management enhances project profitability by controlling costs, avoiding unnecessary expenses, and optimising resource allocation. It ensures that project completion is within budget and generates satisfactory returns.

- Better Project Management: Effective financial management helps track performance of project, identify areas for improvement, and implement corrective measures. It help project managers to make informed decisions, manage risks, and ensure successful project delivery.

- Increased Stakeholder Confidence: When construction companies demonstrate sound financial management practices, they instil confidence in investors, lenders, and other stakeholders. This can help in to increasing the funding opportunities, partnerships, and business growth.

Core Components of Construction Financial Management

Budgeting and Estimating

First, you need to determine the entire project’s cost before it starts. Budgeting includes predicting materials, labour, equipment, and other expenses. Estimating helps ensure you allocate enough money for each part of the project to avoid overspending.

Cost Control Measures

Once the budget is set, cost control is about tracking spending during the project to ensure it doesn’t go over budget. It involves monitoring all expenses and adjusting as needed to stay on track financially.

Cash Flow Management

This component focuses on the timing of the money coming in and going out. Managing cash flow ensures enough cash is available to pay for expenses when needed, such as paying workers or buying materials, without running out of money.

Risk Management

Many risks are involved in the construction industry, such as delays, unexpected costs, or changes in market conditions. Risk management involves identifying potential problems before they happen and planning how to deal with them if they do. It helps minimise financial losses.

Financial Reporting and Analysis

It involves regularly looking at financial reports showing how money is spent and earned. Analysing these reports helps to understand whether the project is on track financially and where improvements can be made. It’s crucial for making informed decisions throughout the project’s duration.

Who is responsible for managing construction finances in a construction company?

In a construction company, the responsibility for financial management typically falls on several key roles, which include:

Chief Financial Officer (CFO) or Finance Director: This is the top financial position in a company. The CFO or Finance Director oversees the entire financial strategy of the company, making high-level decisions about investment, funding, and overall financial planning.

Financial Managers or Controllers: These professionals manage the day-to-day accounting operations and oversee the accounting staff. They are the one who ensures that financial statements are accurate and reflect the company’s financial status.

Construction Finance Manager: This role specifically handles the financial aspects of construction projects, including budgeting, forecasting, cost control, and financial reporting. The construction finance manager ensures that the project stays within budget and follows financial best practices.

These roles work together to ensure that a construction company’s financial operations support its strategic goals and comply with legal standards. They play critical roles in budgeting, risk management, and financial analysis, which are essential for the company’s success and sustainability in the competitive construction market.

How to choose construction financial management software?

Choosing the right construction financial management software involves several critical factors that cater to the specific needs of your construction business. Here’s a guide on how to make this decision effectively:

Identify Your Needs:

Determine what specific financial processes you need to manage with the software. This may include budgeting, accounting, project costing, payroll, and financial reporting. Assess your current challenges and what features will most benefit your operations.

Integration Capabilities:

The software should seamlessly integrate with tools you already use, such as project management systems, CRM software, and any industry-specific solutions. Integration reduces data silos and enhances overall efficiency.

User-Friendly Interface:

Select software with an insightful user interface. The simpler the software, the less training will be required, and the more likely it will be adopted successfully across your organisation.

Scalability:

The software should be able to grow with your business. Consider whether it can manage the volume of your business as it scales in terms of project size, number of transactions, and the complexity of your financial needs.

Cost Effectiveness:

Evaluate the total cost of ownership, including upfront costs, ongoing subscription fees, and any additional costs for training or additional modules. Ensure the cost aligns with your budget and the ROI it offers regarding improved financial management.

Support and Training:

Offering good customer support and training resources are vital. It makes sure that the software provider offers comprehensive support and training to help your team utilise the software fully.

Compliance and Security:

Check that the software complies with industry standards and regulations, including tax regulations and financial reporting standards. Additionally, ensure it has robust security measures to protect your financial data.

Reviews and Recommendations:

Look at reviews from other construction companies. Feedback from current users can help us to get insights into the software’s performance and reliability. Check platforms like Capterra and G2 for ratings and reviews.

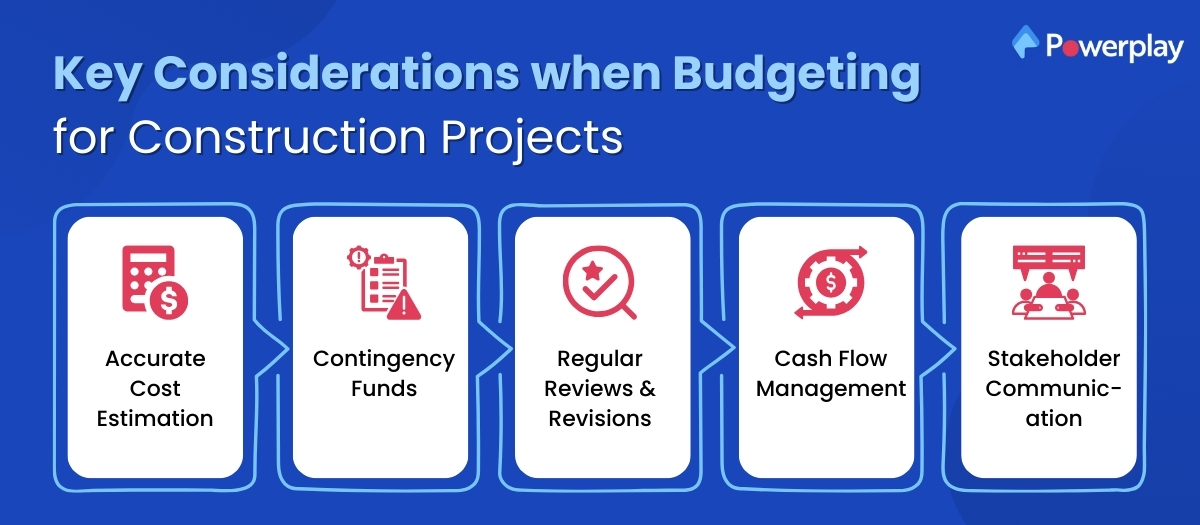

Key Considerations when Budgeting for Construction Projects

When budgeting for construction projects, several key considerations must be taken into account to ensure financial accuracy and project success. Here are a few important considerations:

Accurate Cost Estimation: Begin with detailed and precise cost estimations that include all aspects of the construction project, from materials and labour to permits and equipment. Use historical data, industry standards, and quotes from suppliers to make your estimates as accurate as possible.

Contingency Funds: Include a contingency fund to cover unexpected costs or overruns. This fund typically ranges from 5% to 10% of the total budget, depending on the project’s complexity and risk factors.

Regular Reviews and Revisions: Budgets should not be static. Regular review and revision of the budget as the project progresses are crucial to respond to changes, unexpected expenses, or savings. This dynamic approach allows for adjustments before costs spiral.

Cash Flow Management: Effective cash flow management ensures that there is enough cash on hand to pay bills and purchase materials as needed without delay. Plan the timing of your expenditures and align them with your financing or incoming funds.

Stakeholder Communication: Maintain clear and continuous communication with all project stakeholders about the budget. This includes clients, contractors, and team members. Transparency helps manage expectations and reduces the likelihood of financial disputes.

Best Practices and Strategies for Managing Construction Budgets and Project Cash Flow

Managing construction budgets and project cash flow effectively is critical for success of construction projects.

Here are some best practices and strategies that can help:

- Detailed Budgeting at the Start: Begin every project by setting a detailed budget that breaks down all possible costs, from materials to labour to overhead. This should be based on thorough project planning and realistic cost estimations.

- Use of Financial Management Software: Implement construction-specific financial management software to track costs and manage budgets in real time. This software can help maintain up-to-date records and ensure that all financial data is accurately reflected and easily accessible.

- Regular Financial Reviews: Schedule regular financial meetings to review the budget versus actual spending. This helps identify any discrepancies early and allows for adjustments to be made proactively.

- Effective Cash Flow Forecasting: Develop a robust cash flow forecasting model that anticipates when money will be spent and when payments are expected. This helps in ensuring that the project does not run into liquidity issues.

- Timely Invoicing and Payment Tracking: Ensure that invoicing for work completed is done promptly, and keep a close track of payments. Use incentives for early payments and penalties for late payments to keep a healthy cash flow.

Project Cost Management Strategies for Cost Control and Optimisation

Project cost management is a crucial factor of project management that involves planning, estimating, budgeting, financing, funding, managing, and controlling costs to complete a project within the approved budget. Effective cost management strategies help ensure that a project’s expenses do not exceed its budget, which is vital for its financial success.

Here are some key strategies for cost control and optimisation in project management:

Detailed Cost Estimation

- Method: Use various estimation techniques like parametric, analogue, and bottom-up estimation.

- Purpose: Accurate cost estimation provides a baseline for measuring project performance and helps in identifying the scope of work and the resources required.

Thorough Planning and Scheduling

- Method: Develop a detailed project plan and schedule that includes all project activities, resources, and timelines.

- Purpose: Planning helps in allocating resources efficiently, scheduling tasks to avoid conflicts, and setting realistic timelines that keep the project on budget.

Budget Management

- Method: Create a clear and flexible budget that includes contingencies for unexpected costs.

- Purpose: A well-managed budget ensures that the project can absorb unforeseen expenses without jeopardising the overall financial health.

Earned Value Management (EVM)

- Method: Implement EVM to track project performance and progress in terms of scope, time, and costs.

- Purpose: EVM provides a quantitative measure of project performance and helps detect budget overruns early.

Regular Monitoring and Reporting

- Method: Conduct regular project reviews and financial audits to monitor costs and progress.

- Purpose: Continuous monitoring allows for immediate adjustments in case of deviations from the budget, ensuring that costs are kept within limits.

Resource Allocation Optimisation

- Method: Use resource levelling and resource smoothing techniques to make the most efficient use of available resources.

- Purpose: Optimising resource allocation minimises idle time and reduces the cost of project resources.

Use of Technology and Automation

- Method: Implement project management software and tools for budget tracking, scheduling, and resource management.

- Purpose: Technology can reduce manual errors, save time, and improve accuracy in cost management.

Best Practices and Compliance Requirements for Taxation and Accounting for Construction Projects

The best practices for taxation and accounting compliance in construction projects are:

- Step 1- Understand and Apply Tax Laws Accurately: Ensure that you are familiar with and correctly apply all relevant tax laws that affect construction projects. This includes taxes on materials, labor, and services, as well as understanding specific construction-related deductions and exemptions. Regular updates and consultations with a tax professional can help remain compliant as tax regulations change.

- Step 2- Maintain Detailed Records: Keep comprehensive and organised records of all financial transactions, including invoices, receipts, payroll data, and tax payments. Detailed record-keeping not only supports financial management but is also essential for auditing and tax purposes. Implementing electronic record-keeping systems can enhance accuracy and accessibility of financial data.

- Step 3-Segment Project Accounting: Break down accounting by specific projects or job sites. This practice, known as job costing, allows for more precise tracking of expenses and revenues, aiding in the accurate reporting of each project’s profitability and tax obligations.

- Step 4-Regular Financial Reviews and Audits: Conduct regular reviews and audits of your financial and tax records to ensure accuracy and compliance. These reviews can be internal or performed by external auditors. Regular audits help identify and rectify discrepancies in financial records and help us make sure compliance with accounting standards and tax laws.

Key Takeaways for Effective Financial Management in Construction Projects

Effective financial management is critical in construction projects to ensure profitability, sustainability, and timely completion. Here are some key takeaways for managing finances effectively in construction projects:

- Begin with detailed and accurate budget forecasts based on thorough cost estimations. This sets the financial framework for the entire project.

- Maintain a positive cash flow by scheduling expenditures and ensuring timely invoicing and payment collections. This helps avoid financial shortfalls during the project.

- Regular financial assessments should be conducted to compare actual expenses against the budget. This allows for early detection of financial issues and corrective actions.

- Implement strict cost control measures, including tracking and auditing all costs. Use technology to enhance transparency and accuracy in cost reporting.

- Leverage construction management software for financial tracking and management. This includes budgeting, accounting, and invoicing tools, which can automate and streamline financial operations.

- Have a robust system in place to manage change orders effectively. This includes clear protocols for approving additional expenses and adjusting the budget and schedule accordingly.

- Identify financial risks early in the project and develop mitigation strategies. This includes allocating contingency funds to address unforeseen expenses.

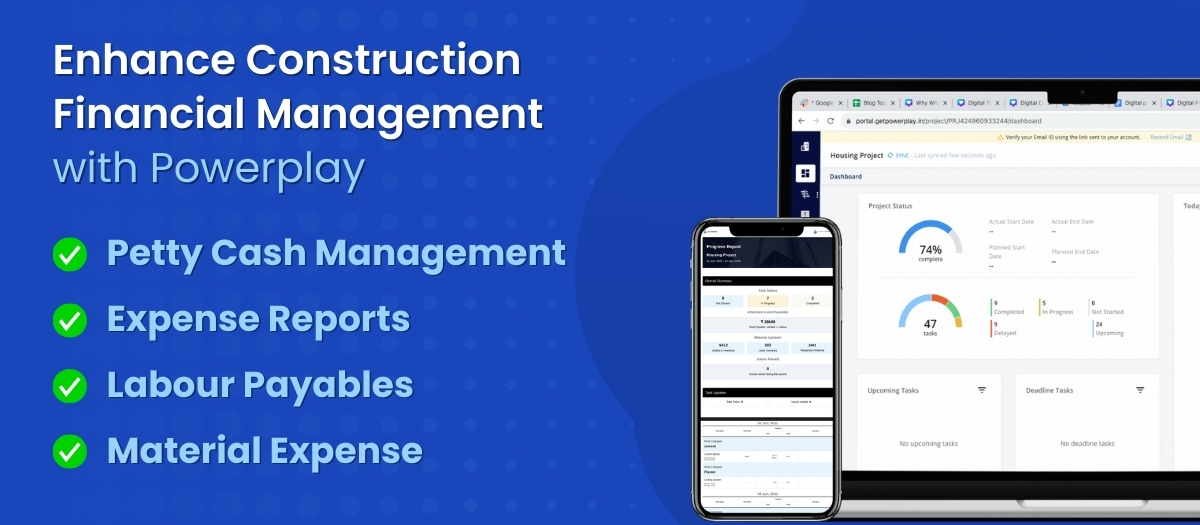

How Powerplay helps with Construction Financial management?

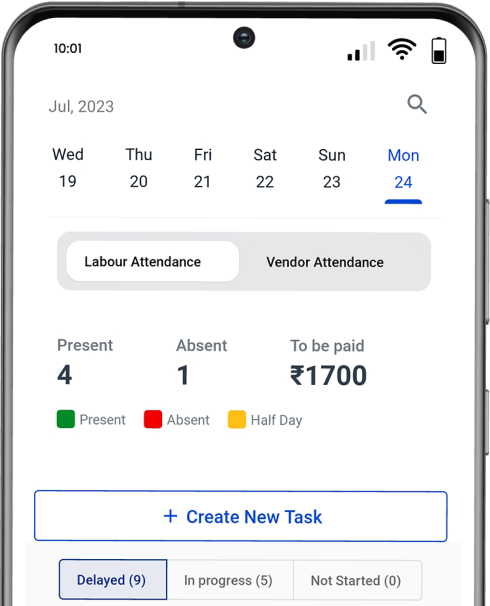

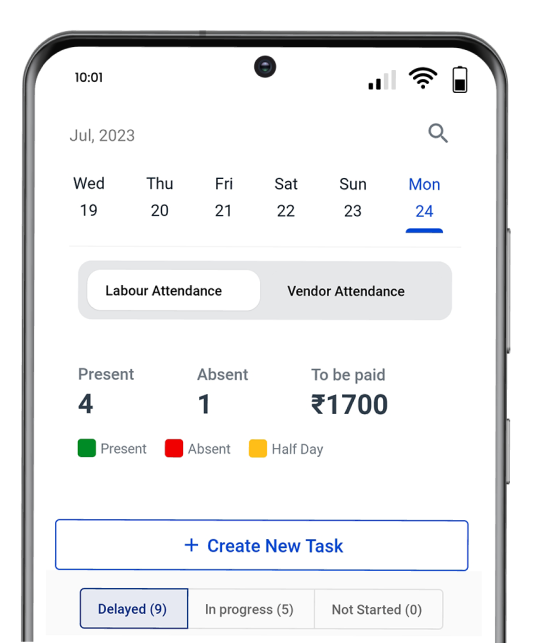

Powerplay is robust construction management software that streamlines construction site financial operations. It offers various features to enhance transparency and control over project finances, helping firms manage costs effectively.

Here’s how Powerplay’s features can benefit construction financial management:

Petty Cash Management: This feature allows for the efficient handling of petty cash transactions, which is common in construction sites for small, incidental expenses. Powerplay helps track these transactions accurately and ensures that all petty cash usage is recorded and reconciled. This improves transparency and control over small cash flows, reducing the risk of mismanagement or fraud.

Expense Reports: Powerplay enables the creation and management of detailed expense reports. This feature helps project managers and financial controllers to monitor and analyse expenses against the budget. Providing a clear view of where funds are being spent, it aids in identifying areas of overspending and potential savings, facilitating better budget management.

Labour Payables: Managing labour costs effectively is critical in construction. Powerplay’s labour payables feature assists in tracking all payments due to workers, including wages, bonuses, and other compensations. It ensures that all labour-related financial obligations are met on time and documented properly, which supports compliance with labour laws and helps maintain good relations with the workforce.

Material Expense: Effective management of material expenses is crucial for keeping construction projects within budget. Powerplay offers tools to track material purchases, usage, and costs. This feature helps prevent over-ordering and reduces waste by allocating materials efficiently across various project stages.

Conclusion

Mastering construction financial management is more crucial than ever. Powerplay helps you enhance your construction financial management more effectively by providing robust tools for monitoring and controlling different aspects of project finances that help construction owners maintain financial discipline, ensure compliance, and improve profitability through better financial oversight and resource management.

So try using Powerplay to manage all your finances. Request for a free demo, or download the Powerplay mobile application now.