GST on Construction Materials: Rates in 2024

-

Dharmesh Dave

Dharmesh Dave

- June 29, 2024

The construction industry is the backbone for economic development, and understanding the Goods and Services Tax (GST) rates applicable to building and construction materials is important for anyone involved in this sector.

In 2024, GST on construction materials will continue to play a pivotal role in determining the cost structure of construction projects, impacting everything from raw materials to labour services. This detailed guide aims to provide an overview of the GST rates on various construction materials and services, ensuring that stakeholders can make informed decisions and optimise their project budgets effectively. Whether you are a contractor, builder, or homeowner, staying updated on these rates will help you navigate the financial landscape of construction in 2024 with confidence.

Table of Contents

Understanding GST

Understanding the Goods and Services Tax (GST) and its implications on various sectors is crucial for businesses and consumers alike. In 2024, the construction industry, including building construction, continues to be significantly influenced by GST rates, which affect everything from raw materials to services. This extensive guide will delve into the current GST rates on construction materials, helping you navigate this essential aspect of the construction process.

What is GST?

GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the manufacture, sale, and consumption of goods and services in India. Introduced to streamline the indirect taxation system, GST replaces multiple taxes and creates a uniform tax regime across the country. The GST Council periodically reviews and updates these rates to reflect economic conditions and industry needs.

What are the GST Rates on Common Construction Materials?

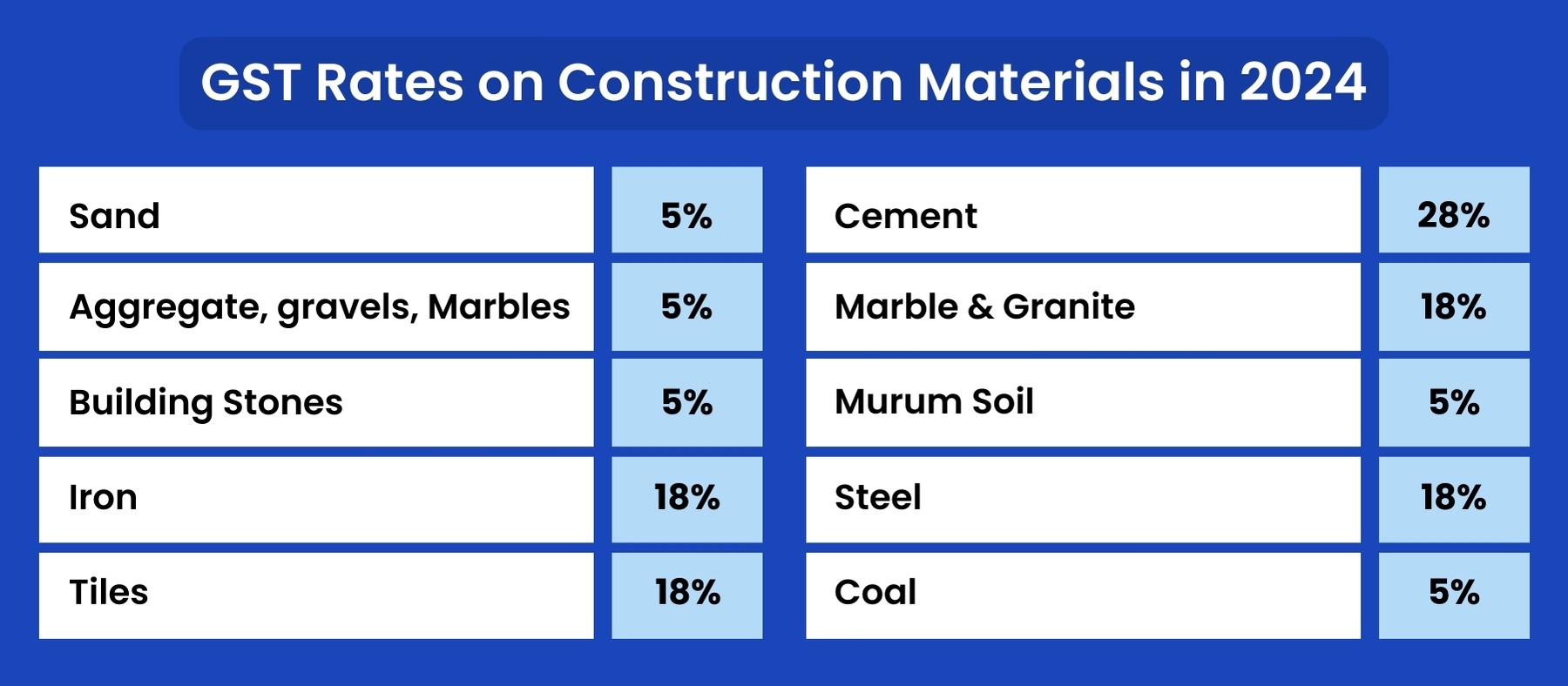

GST Rates on Construction Materials in 2024

Here’s a detailed look at the GST on building materials in 2024:

GST rate on sand 2024

In 2024, the GST rate on sand remains at 5%. Sand is a fundamental component in construction, used in concrete mixes, plastering, and other applications.

GST on cement 2024

Cement is taxed at a higher rate of 28%, reflecting its critical role and the extensive use in the construction industry. This includes various types of cement such as portland cement, resin cement, and similar hydraulic cement, all of which are taxed at 28%.

GST rate on bricks 2024

The GST rate on bricks is 5%, applicable to both normal and fly ash bricks, making it affordable for various building projects.

Building blocks, including those made of cement, artificial stone, or concrete, also fall under this category and are subject to the same GST rate.

GST on crushed stones, gravels and marbles 2024

Crushed stones, gravels, and marbles are taxed at 5%. These materials are essential for road construction, concrete mixes, and decorative purposes.

Granite blocks, which are commonly used in construction, attract a GST rate of 12%.

GST on marble and granite stones 2024

Marble and granite stones, popular for their aesthetic appeal and durability, attract an 18% GST rate.

GST rate on building stones 2024

Building stones, used in masonry work and decorative facades, are taxed at 5%.

GST rate on Murum Soil 2024

Murum soil, utilised in road construction and as a filling material, carries a 5% GST rate.

GST on iron 2024

Iron and steel products, crucial materials for construction frameworks and reinforcement, are taxed at 18%.

GST on steel 2024

Similar to iron, steel, which is part of iron and steel products, attracts an 18% GST rate, reflecting its importance in structural construction.

GST rate for tiles 2024

Tiles, used for flooring and wall applications, are subject to an 18% GST rate. Bamboo flooring tiles have an 18% GST rate, while earthen or roofing tiles are taxed at a lower rate of 5%.

GST on coal 2024

Coal, essential for power generation and industrial processes, carries a 5% GST rate.

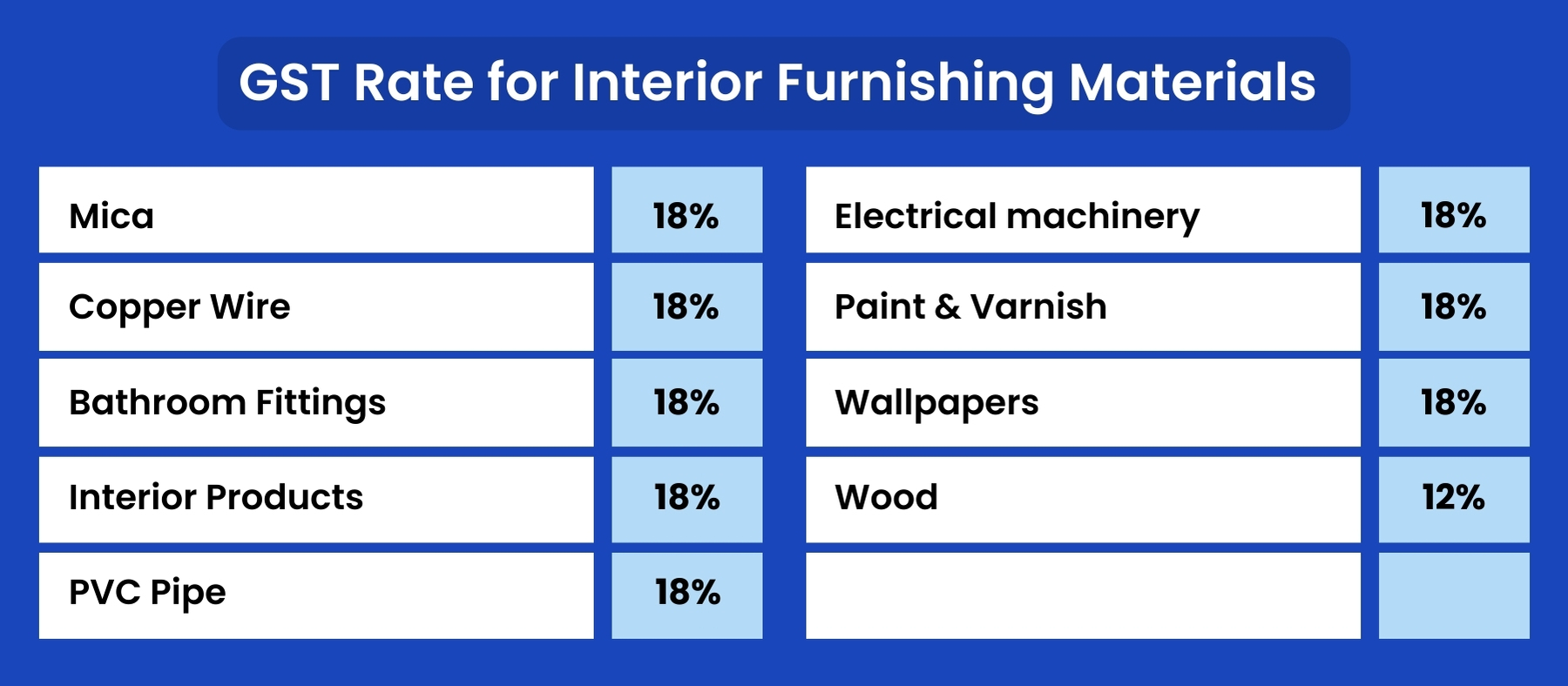

GST rate for interior furnishing materials of a building in 2024

GST on mica 2024

Mica, used for insulation and decorative purposes, is taxed at 18%.

GST rate on electrical machinery 2024

Electrical machinery, including wiring and switches, attracts an 18% GST rate.

GST on copper wire

Copper wire, crucial for electrical installations, is subject to an 18% GST rate.

GST rate on paint and varnish 2024

Paint and varnish, used for finishing and protection, are taxed at 18%.

GST rate on bathroom fittings 2024

Bathroom fittings, essential for modern sanitation, carry an 18% GST rate.

GST rate on wallpapers 2024

Wallpapers, a popular interior design element, attract an 18% GST rate.

GST on interior products

Various other interior products like curtains, blinds, and furniture parts generally fall under the 18% GST category.

GST on wood

Wood, used extensively in furniture and fittings, is taxed at 12%.

GST on PVC pipe

PVC pipes, essential for plumbing, carry an 18% GST rate.

GST Rates for Construction Services 2024

Labour and Contractor Services

Construction labor and contractor services attract a 12% GST rate, essential for project execution.

Contractors and service providers can also benefit from input tax credit (ITC), which allows them to offset the GST paid on inputs against the GST collected on outputs.

Architectural and Design Services

Architectural and design services, crucial for planning and aesthetics, are taxed at 18%.

GST rates on real estate projects 2024

GST on real estate projects varies depending on the type of project. Affordable housing projects attract a lower rate of 1%, while other projects are taxed at 5%.

Under construction properties intended for sale are considered a supply of service and are liable for GST, with specific exemptions and concessions under the GST law.

GST rate on goods transportation

The transportation of goods, including construction materials, is taxed at 5%, ensuring efficient supply chain management.

Conclusion

Understanding the GST rates on construction materials is vital for cost-effective project planning and execution. By staying informed about these rates, stakeholders can make strategic decisions that optimise budget and compliance.

Share

Dharmesh Dave is a communications professional with eight years of experience in crafting PR, branded, and marketing content for real estate and construction industries. His passion lies in the art of creative storytelling, making him a zestful force in the field of communication.