Work In Progress Accounting: What Is It and Why Is It Important?

-

Sapna

- May 14, 2024

Work-in-Progress (WIP) accounting is a crucial aspect of financial management in the construction industry. It involves tracking the costs and revenues associated with ongoing projects to provide a clear picture of a company’s financial health. Many construction companies face challenges in maintaining accurate financial records due to the complex nature of project accounting. Errors in WIP accounting can lead to budget overruns, cash flow issues, and inaccurate financial reporting. Understanding WIP accounting is essential for making informed decisions, optimising resources, and ensuring the profitability and sustainability of construction projects.

In this blog, we’ll explore why Work In Progress accounting is mandatory for maintaining the financial health and operational efficiency of construction projects. We’ll also understand all the important components of WIP.

Table of Contents

What Is a Work-in-Progress (WIP) in the Manufacturing Process?

A Work-in-Progress (WIP) refers to the unfinished items or tasks within a project, particularly in the manufacturing, construction, and software development industries. It encompasses all the materials, labour, and overhead costs invested in the products or tasks that have not yet reached the final stage of completion.

In industries like manufacturing, WIP is also referred to as ‘in-process inventory’, encompassing all production costs for partially completed goods. This terminology highlights the flow of manufacturing costs from one area of manufacture to the next, and the balance in work in progress portrays the entire production costs incurred for partially completed goods.

WIP is a critical aspect of inventory and project management, as it helps in tracking the value of ongoing work and is essential for accurate financial reporting and operational efficiency. By monitoring WIP, businesses can optimise production processes, manage cash flow, and ensure timely completion of projects.

Understanding Works-in-Progress (WIP) and their Components

WIP accounting is a cornerstone of financial clarity in the construction sector. However, it is the WIP report that provides a dynamic, up-to-the-minute snapshot of a project’s financial health.

To adeptly maneuver through the intricacies of construction accounting, one must grasp the critical components of a WIP report. This section offers an in-depth exploration of each element, highlighting its role and importance in the financial framework.

- Contract Overview: This segment captures essential project information such as the job name and number, the total value of the contract with any adjustments for change orders, the comprehensive estimated costs to finalise the contract, including change orders, and the projected gross profit.

- Actual Job Totals: This portion presents an immediate view of the project’s financial and performance status:

- Completion Percentage: This metric shows how much the project is finished as of the report’s date. It is typically computed using the percentage of completion method, which compares actual costs incurred to the estimated total costs.

- Actual Costs: These are the total expenses accumulated for the project. They include both direct costs like materials, direct labour costs, and subcontractor fees and indirect costs such as overhead, equipment use, and administrative expenses. Understanding the associated costs, including the challenges of valuing WIP and minimising these costs, is crucial for better financial management.

- Earned Revenue: This figure represents the total revenue earned based on the completed work. It’s crucial for accurate revenue recognition.

- Gross Profit: It is calculated by subtracting the actual costs from the earned revenue, offering insights into the project’s profitability.

- Actual Billings: This shows the total amount invoiced to the client for the work done so far, encompassing both progress billings and retainage.

- Over- and Underbilling: This section points out the discrepancies between actual billings and earned revenue.

Work-in-Progress vs. Work-in-Process

| Aspect | Work-in-Progress (WIP) | Work-in-Process |

| Definition | Refers to unfinished projects or tasks in industries like construction. Where the focus is on the overall progress and financial aspects of the project. | Primarily used in manufacturing, it refers to goods in various stages of the production process that have not yet been completed. |

| Key Focus | Tracks the financial progress, cost management, and scheduling of long-term projects. | Focuses on managing and optimising the production flow, inventory, and operational efficiency. |

| Typical Industries | Construction, software development, and large-scale engineering projects. | Manufacturing, assembly lines, food processing. |

| Primary Components | Costs incurred, work completed, revenue recognised, contract value. | Raw materials, labour costs, overheads, stages of production. |

| Measurement | Often measured based on the completion percentage, linking financial metrics with project milestones. | Measured in terms of units or volume of goods in production at a given time. |

What Does Work-in-Progress Mean in Job Costing Accounting?

In accounting, especially within the construction industry, “Work-in-Progress” (WIP) refers to the costs incurred for incomplete construction work related to long-term assets or fixed assets. This account is recorded as an asset on the balance sheet under non-current assets until the construction is complete. The costs encompassed in WIP are not subject to depreciation until the asset is fully operational and serves the business’s purposes.

How Is Work-in-Progress Calculated?

The calculation of WIP involves several steps:

- Percentage of Work Completed: This measures the progress of the project by dividing actual costs to date by the total estimated costs.

- Earned Revenue to Date: After determining the percentage of work completed, it’s used to estimate the total revenue and derive the earned revenue up to that date.

- Over/Under Billed Revenue: This is the difference between total billings on the contract and the earned revenue to date.

Project Monitoring, Issue Identification and Informed Decision-Making

Project Monitoring:

This involves observing the progress and performance of a project to ensure it aligns with planned objectives and timelines. It includes tracking key performance indicators (KPIs), ensuring deliverables meet quality standards, and using project management tools like Trello or Wrike for effective monitoring. Effective inventory management is crucial in this context, as it optimises the production process and manages cash flow by reducing the time inventory spends in the work in progress (WIP) stage and applying strategies like Just-In-Time (JIT) to minimise WIP costs. The goal is to identify any deviations early on and make necessary adjustments.

Issue Identification:

This is the process of recognising problems or potential risks that could affect the project’s outcome. It involves constantly reviewing project activities and outputs to detect any signs of issues such as scope creep, unclear goals, or resource constraints. Incorporating job costing into this process plays a crucial role in identifying financial issues early in the project lifecycle, allowing for the tracking of costs and profits for specific, individual projects and preventing minor issues from increasing into major problems. Effective issue identification, enhanced by job costing, ensures smoother project execution by allowing accountants to trace expenses for each job for tax purposes and analysis.

Informed Decision-Making:

This refers to making decisions based on data and insights gathered through project monitoring and issue identification. By understanding the project’s current state and potential issues, project managers can make strategic decisions to steer the project back on track, optimise resources, and adjust timelines if necessary. This process is crucial for maintaining the project’s integrity and meeting stakeholder expectations.

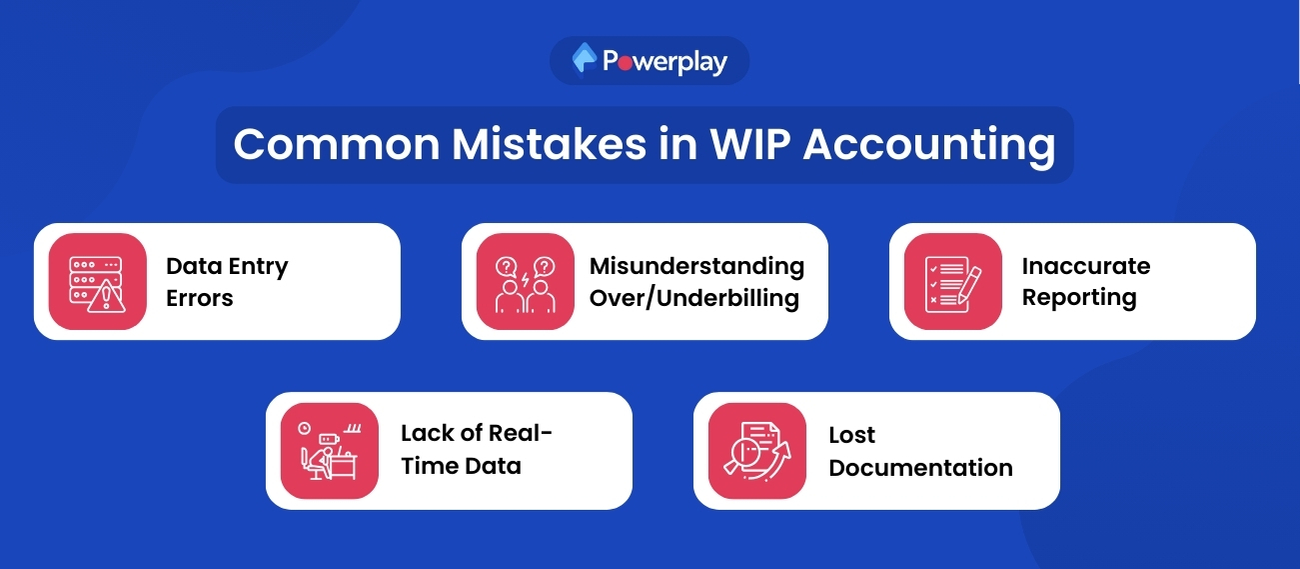

Common Mistakes in Work in Progress Accounting

Common mistakes in WIP (Work-in-Progress) accounting in construction often stem from the complexities of tracking such a dynamic aspect of project management. Here are some of the typical errors:

- Data Entry Errors: Manual processes, like using spreadsheets for tracking, can lead to data entry mistakes, duplicate entries, and non-standardised data. These can distort the financial picture of a project.

- Misunderstanding Over/Underbilling: Properly calculating whether a project is over or underbilled is crucial. Errors here can result in negative cash flow issues or inflated revenue reports, leading to incorrect tax obligations.

- Incomplete or Inaccurate Reporting: Failing to include all necessary components in a WIP report, such as total contract amount, estimated costs, per cent completion, over/under billings, and especially ‘partially completed goods’ in the inventory account, can skew the project’s financial health assessment. A common area where mistakes occur is in the transition of costs from WIP to the finished goods account, leading to inaccuracies in financial reporting. It’s also important to update the inventory value of finished goods accurately as goods move through the production process.

- Lack of Real-Time Data: Using outdated information for WIP calculations can lead to inaccurate reports. Modern construction requires real-time data from the field to the office for precise accounting and project management.

- Miscommunication and Lost Documentation: Human errors, like forgotten invoices or miscommunications, can result in financial discrepancies and affect the overall accuracy of WIP reports.

Case Study: Improving Construction Projects Financial Health with Effective WIP Accounting

Background: A mid-sized construction company faced challenges in managing its projects, particularly in financial oversight. They often encountered overruns and inaccuracies in their budgeting and billing processes. Their projects typically exceeded original timelines by 25%, and budget overruns were common, averaging around 15%.

Challenge: The primary issue was the lack of accurate and timely financial reporting on ongoing projects. The company relied heavily on manual data entry using spreadsheets, which led to frequent errors and delays in updating project statuses. This lack of precision in their WIP accounting resulted in both overbilling and underbilling scenarios, distorting cash flow and affecting project profitability.

Solution: The company adopted construction-specific accounting software that enabled real-time data tracking and automated WIP reporting. This software integrated field data with financial records, allowing for immediate updates and more accurate project progress tracking. The adoption of methods to better manage their progress inventory and progress account for real-time tracking significantly improved how the company handled progress work, enhancing project management and financial reporting by accurately tracking ongoing jobs.

Results:

- Reduction in Budget Overruns: By implementing accurate WIP accounting, the company reduced its average budget overruns from 15% to just 5% within a year.

- Improved Billing Accuracy: Overbilling was reduced by 10%, and underbilling scenarios were minimised, leading to a healthier cash flow.

- Increased Project Efficiency: With real-time updates, the company was able to identify and address issues faster, leading to a 10% improvement in project completion times.

- Better Financial Health: Overall, the company saw a 20% improvement in its profit margins on projects. Due to better control and visibility over costs and revenues.

This case study demonstrates the significant impact that effective WIP accounting can have on a company’s financial and operational performance. By moving away from manual processes and embracing automated, real-time tracking, the company improved its financial health and enhanced its project management capabilities.